Why Health Insurance Is Important and Who Needs It Most

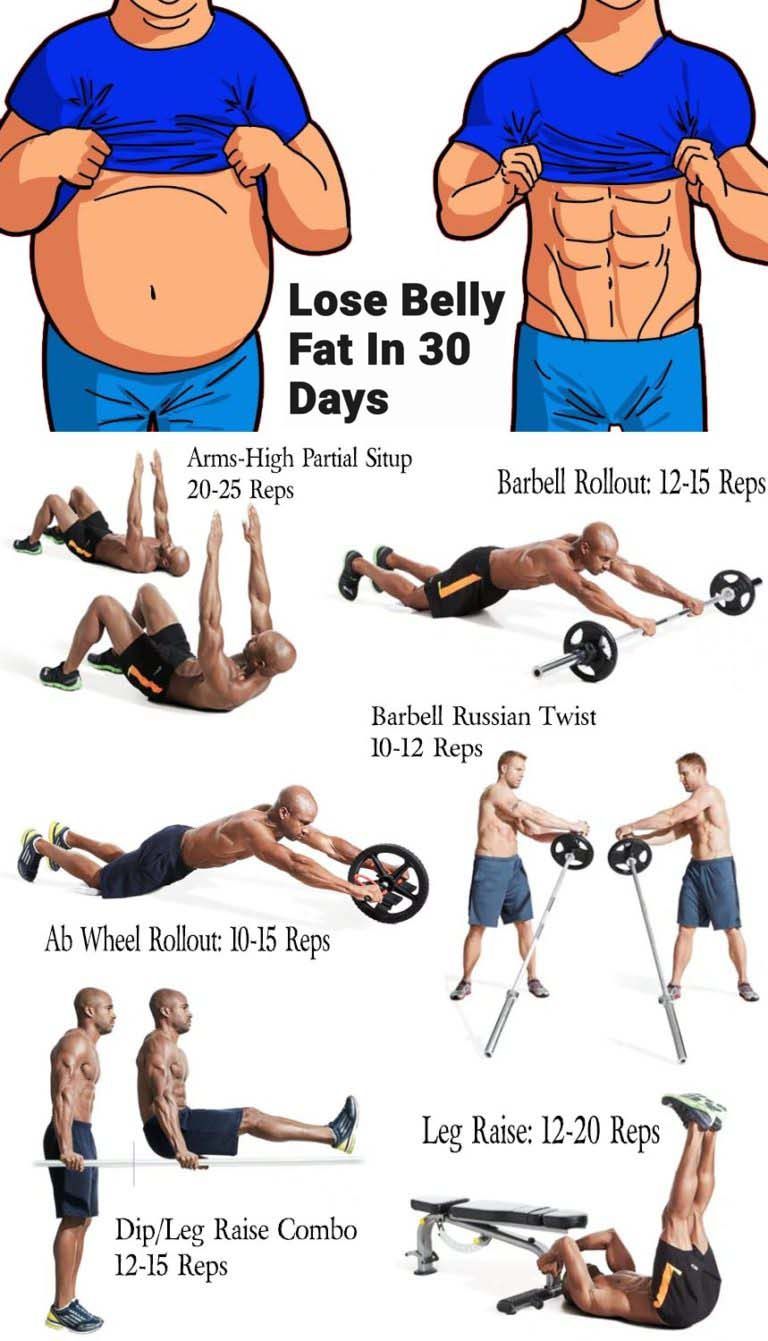

New Delhi: With medical costs rising steadily and lifestyle diseases increasing across age groups, health insurance has become less of a luxury and more of a necessity. Financial planners and healthcare experts say that a single hospitalization can wipe out years of savings, making medical coverage a critical safety net for families.

Rising Healthcare Costs Drive Demand

In recent years, the cost of hospital stays, surgeries, diagnostic tests, and specialist consultations has surged. Even a short hospital admission in a private facility can run into lakhs of rupees. Without insurance, families often rely on savings, loans, or credit, leading to financial stress.

Health insurance helps cover hospitalization expenses, pre- and post-hospitalization costs, daycare procedures, and in some cases, preventive health check-ups. Many policies also offer cashless treatment at network hospitals, reducing the burden of arranging funds during emergencies.

Who Needs Health Insurance?

Experts say health insurance is essential for nearly everyone, but it is particularly important for:

1. Young Professionals:

Many in their 20s and 30s assume they are healthy and delay buying insurance. However, purchasing a policy early ensures lower premiums and coverage before any medical condition develops.

2. Families with Dependents:

For households with children or elderly parents, a family floater plan can provide comprehensive coverage under one policy. Medical emergencies can arise unexpectedly, and insurance ensures financial stability during such times.

3. Senior Citizens:

With advancing age, the risk of illness increases. Senior citizen plans cater specifically to older individuals, though premiums may be higher. Early planning can help avoid coverage gaps.

4. Individuals with Pre-existing Conditions:

People with conditions such as diabetes, hypertension, or heart disease face higher healthcare costs. Insurance policies typically have waiting periods, so early enrollment is crucial.

5. Self-Employed Individuals:

Unlike salaried employees who may receive employer-provided coverage, freelancers and business owners must secure personal health insurance to avoid exposure to large medical bills.

Protection Beyond Hospital Bills

Modern health insurance policies often include additional benefits such as wellness programs, mental health coverage, maternity benefits, and critical illness riders. Critical illness coverage provides a lump-sum payout upon diagnosis of serious diseases like cancer, stroke, or kidney failure.

Furthermore, tax benefits under applicable laws allow policyholders to claim deductions on premiums paid, adding to the financial advantages of coverage.

The Risk of Being Uninsured

Health emergencies are unpredictable. Without insurance, families may be forced to liquidate assets or compromise on the quality of care. Studies show that medical expenses are one of the leading causes of financial distress in many households.

Insurance acts as a financial shield, ensuring that medical treatment decisions are based on health needs rather than affordability concerns.

Conclusion

As healthcare inflation continues and medical advancements expand treatment options, having adequate health insurance is becoming essential. Whether young or old, salaried or self-employed, securing a suitable health plan can safeguard both physical well-being and financial stability.

In an uncertain world, health insurance remains one of the most reliable tools for long-term financial protection and peace of mind.

Note: Content and images are for informational use only. For any concerns, contact us at info@rajasthaninews.com.

40 के बाद शर्ट से बा...

Related Post

Hot Categories

Recent News

Daily Newsletter

Get all the top stories from Blogs to keep track.

_1771509335.jpg)

_1771508976.jpg)

_1771508451.jpg)

_1771507776.jpg)