OpenAI and Nvidia Announce $100 Billion Chip Deal to Power AI Future

- byAman Prajapat

- 24 September, 2025

In a move that could reshape the landscape of artificial intelligence infrastructure, OpenAI and Nvidia have signed a letter of intent to form a strategic partnership worth up to $100 billion. Under the deal, Nvidia will progressively invest in OpenAI and simultaneously provide it with the advanced data-center chips needed to power AI at scale.

Key Features of the Deal

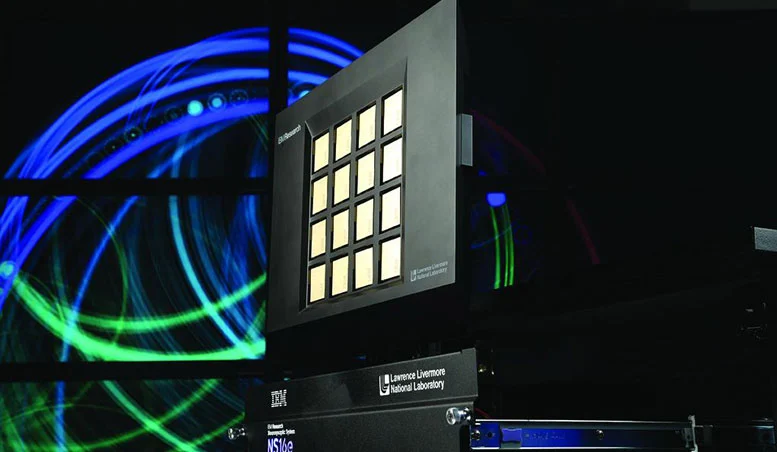

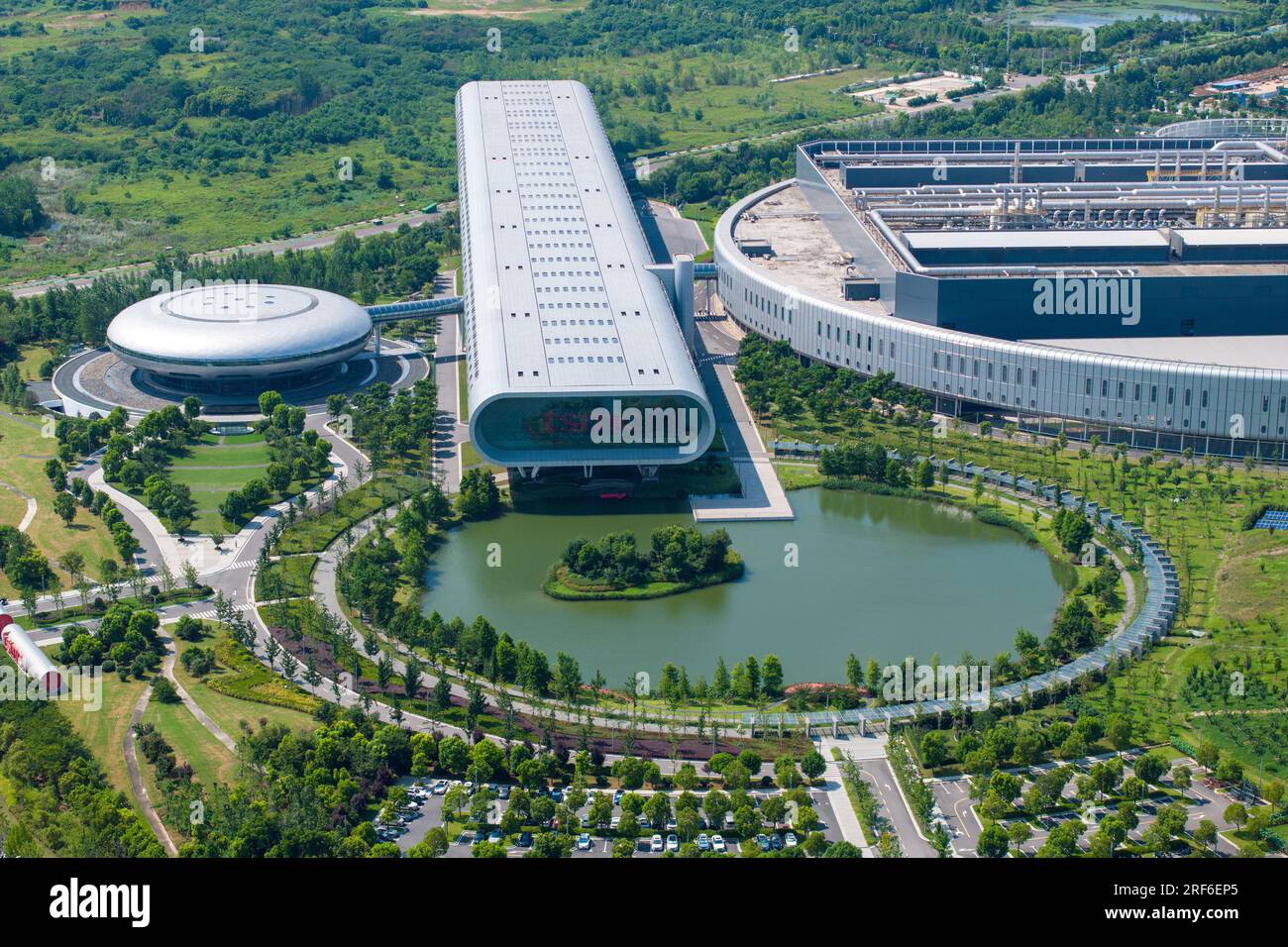

10 Gigawatts of Compute: The agreement stipulates deploying at least 10 gigawatts of Nvidia systems (i.e. massive GPU and compute capacity) for OpenAI’s next-gen AI infrastructure.

Phased Investment: Nvidia will invest gradually, tied to deployment milestones. The first tranche is expected to be $10 billion once a definitive hardware purchase agreement is signed.

Non-Voting Shares + Chip Purchases: The structure involves Nvidia acquiring non-voting shares in OpenAI, while OpenAI uses the funds to procure Nvidia hardware. It’s a somewhat “circular” financial arrangement, which has already attracted scrutiny.

Timeline & Platform: Hardware deliveries are expected to begin in late 2026, using Nvidia’s Vera Rubin platform for at least the first gigawatt deployment.

Power & Infrastructure Demand: The energy and infrastructure demands of 10 gigawatts of compute are enormous. The deal underscores that compute is now the foundation of future economies. “Everything starts with compute,” OpenAI CEO Sam Altman remarked.

Strategic Implications & Risks

Dominance & Competitive Edge: Nvidia is already a dominant supplier of AI chips. With this deal, it gains both a guaranteed major customer and a stake in OpenAI, possibly strengthening its grip on the AI hardware-software axis.

Antitrust Concerns: Legal experts are cautioning that such a close tie could disadvantage other AI firms or chip makers. The deal may invite regulatory scrutiny in the U.S. and abroad.

Circular Financing Critique: One of the more controversial angles is that Nvidia’s investment may effectively flow back to itself, since OpenAI will use the money to buy Nvidia hardware. Critics argue this blurs financial lines.

Power & Grid Impact: Deploying tens of gigawatts of compute will stress power infrastructure. Access to electricity is becoming a potential bottleneck for such large AI projects.

OpenAI’s Independence & Hardware Plans: Despite this partnership, OpenAI is reported to be continuing work on its own custom chips (with Broadcom) to reduce reliance on Nvidia.

Broader AI Landscape & Reactions

After the announcement, Nvidia’s stock jumped roughly 4%, reflecting market optimism about the strategic alignment.

Other tech players — Microsoft, Oracle, SoftBank — are already involved in AI infrastructure projects with OpenAI (e.g. the Stargate initiative). This Nvidia deal complements those efforts.

Analysts are divided: some see this as a bold step toward securing compute dominance; others warn it could stifle competition and entrench monopolies.

What to Watch Next

Regulatory Review: Will U.S. agencies (DOJ, FTC) or foreign regulators challenge the deal?

Final Agreement Terms: The detailed contract will clarify exactly how much Nvidia invests, when, and under what conditions.

Power & Infrastructure Buildout: How will OpenAI ensure steady, scalable power supply and data center infrastructure?

Impact on Competitors: How will other AI firms and chipmakers respond? Can they keep up?

OpenAI’s Dual Strategy: Will its own chip development plans alter the dynamics of this partnership?

Note: Content and images are for informational use only. For any concerns, contact us at info@rajasthaninews.com.

TSMC Optimistic Amid...

Related Post

Hot Categories

Recent News

Daily Newsletter

Get all the top stories from Blogs to keep track.