Zomato’s IPO Journey and Stock Market Growth: From Launch to Profit

- bySheetal

- 30 July, 2025

Zomato made headlines in July 2021 with one of India’s most anticipated IPOs, attracting massive investor interest.

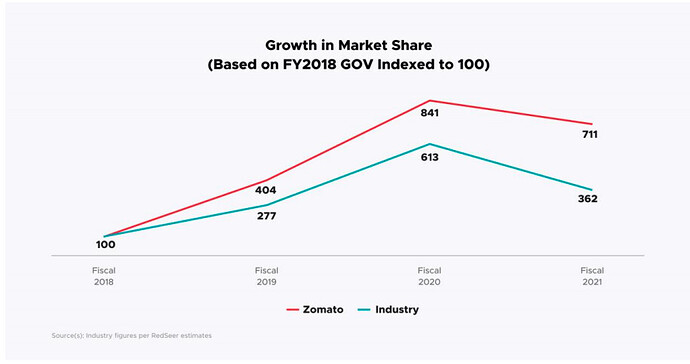

The IPO was oversubscribed nearly 38 times, and the stock debuted at over 50% above its issue price. Although it faced a sharp decline in 2022, Zomato rebounded strongly, delivering more than 130% returns by 2024. Key factors behind this turnaround include a net profit of ₹176 crore, strong revenue growth, and operational improvements, including positive adjusted EBITDA. Zomato’s strategic acquisition of Blinkit and its leadership in India’s online food delivery space have made it a favorite among investors and analysts alike. With a strong outlook, improving margins, and a diversified business model, Zomato continues to rise as a major player in the Indian stock market.

Note: Content and images are for informational use only. For any concerns, contact us at info@rajasthaninews.com.

जयपुर मे सोने और चां...

Related Post

Hot Categories

Recent News

Daily Newsletter

Get all the top stories from Blogs to keep track.